child tax credit 2021 dates irs

The New HR Block Tax Calculator Apr 1. The child tax credit is a non.

Child Tax Credit Update Next Payment Coming On November 15 Marca

HomeNewsTech Child tax credit 2021.

. And while for many the checks and direct deposits have arrived on time each. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. Tax Refund Schedule Dates 2021 2022.

If the Internal Revenue Service imposes a federal adjustment on a return filed Revenue and Taxation Code RTC Section 18622 requires the taxpayer to notify us within six months. Irs stimulus check 2022 dates. The updated Child Tax Credit may provide some relief.

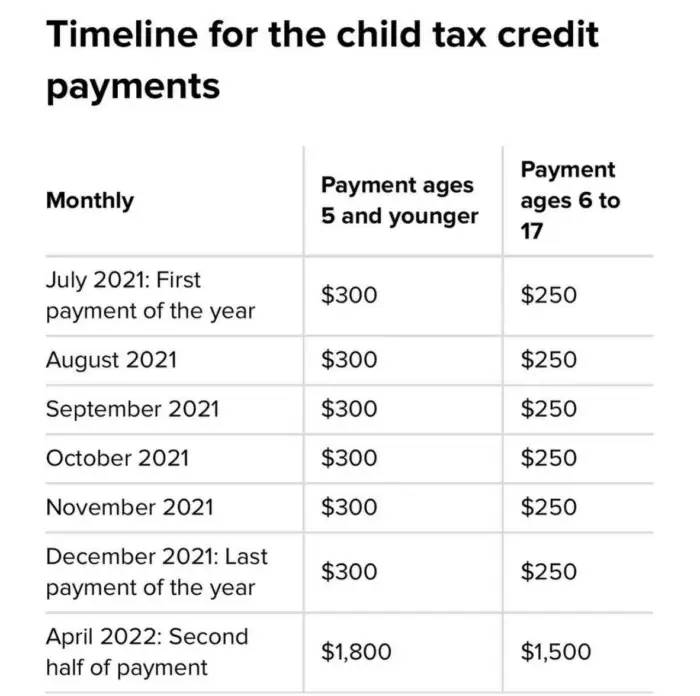

3000 for children ages. Monthly payment dates opt-out deadlines IRS portal details. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

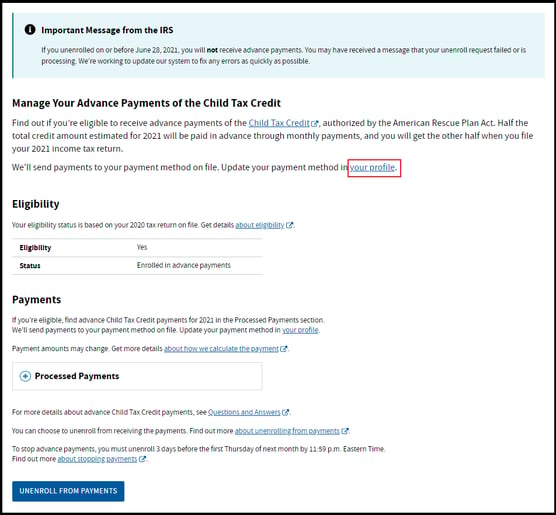

New Tax Credits and Deductions. To do that go to the Child Tax Credit Update Portal to unenroll from the monthly payments. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

Starting July 15 2021 the Internal Revenue Service IRS will pay most parents up to 300 per month per child. The IRS will send out the next round of child tax credit payments on October 15. The deadline to file 2021 income tax returns is Monday April 18 for most people three days later than the normal April 15 deadline for filing taxes.

Here are the official dates. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. For each qualifying child age 5 and younger up to 1800 half the total.

Advanced Payments of the Child Tax Credit 2021 CTC paid made monthly from July-December to eligible taxpayers starting 0715. Child Tax Credit Dates Here S The Entire 2021 Schedule Money 2 days agoAccording to a recent audit from The Treasury Inspector General for Tax. The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that passed in March.

How do I unenroll from the CTC. The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child. Search Taxpayer Bill of Rights.

The IRS says the monthly payments will be. Child Tax Credit Changes. The IRS began sending advance monthly payments to parents and guardians in July 2021 Nearly 90 percent of advanced Child Tax Credit payments were paid through direct deposit.

The IRS pre-paid half the total credit amount in monthly payments from. 3600 for children ages 5 and under at the end of 2021. 15 The payments will be made either by direct deposit or by paper check depending on what.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The remainder will come when parents file. Update your direct deposit info or mailing address through the IRS portal.

Tas Tax Tips Early Information About Advanced Child Tax Credit Payments Under The American Rescue Plan Act Taxpayer Advocate Service

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

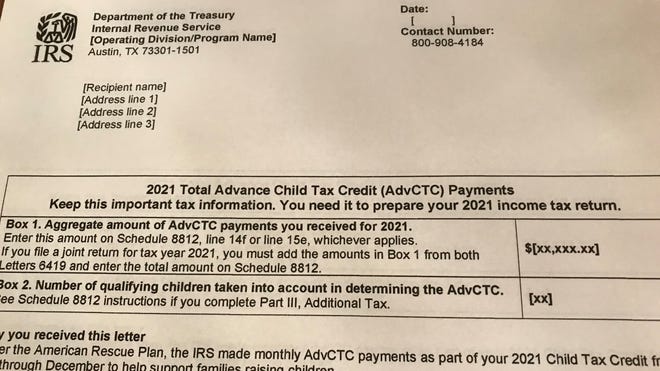

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

When Do We Get The Child Tax Credit 2021 Payment Schedule In Full

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

New Child Tax Credit Monthly Advance Payments

What To Bring Campaign For Working Families Inc

Child Tax Credit What We Do Community Advocates

What Is The Child Tax Credit Tax Policy Center

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Advance Child Tax Credit Payments From Irs Might Not Be Available For Parents Of Kids Who Were Born In 2021

What Is The Irs Child Tax Credit Letter 6419

News On 2021 Child Tax Credit Refunds Irs Hiring Plans Canon Capital Management Group Llc